Introduction RERA:-

The Real Estate Regulatory Authority (RERA) plays a crucial role in regulating the real estate sector and safeguarding the interests of both buyers and developers. In this comprehensive guide, we delve into the intricacies of RERA, shedding light on its functions, significance, and impact on the real estate landscape.

What is RERA?

RERA, also known as the Real Estate (Regulation and Development) Act, 2016, is a landmark legislation enacted by the Government of India to bring transparency, accountability, and efficiency to the real estate market. It aims to protect the interests of homebuyers and promote fair practices in the sector.

Objectives of RERA

The objectives of the Real Estate Regulatory Authority (RERA) include:

Ensuring Transparency and Accountability: RERA aims to bring transparency and accountability to the real estate sector by requiring developers to provide accurate information about their projects, including approvals, timelines, and financials.

Protecting Homebuyers’ Interests: RERA seeks to safeguard the interests of homebuyers by establishing a regulatory framework that prevents fraudulent practices, ensures fair treatment, and provides mechanisms for redressal in case of disputes.

Promoting Timely Completion of Projects: One of the key objectives of RERA is to promote the timely completion of real estate projects. By imposing strict guidelines and penalties for project delays, RERA aims to minimize disruptions and uncertainties for homebuyers.

Regulating Real Estate Transactions: RERA regulates various aspects of real estate transactions, including project registration, advertisement, sales, and post-sales obligations. This regulatory oversight helps maintain integrity and fairness in the market.

Enhancing Investor Confidence: By instilling confidence in investors through transparency, accountability, and regulatory compliance, RERA aims to attract more investments into the real estate sector, thereby stimulating growth and development.

The primary objectives of RERA include:

Ensuring transparency and accountability in real estate transactions.

Establishing a regulatory framework to govern the real estate sector.

Protecting the rights and interests of homebuyers against fraudulent practices.

Promoting timely completion of real estate projects to minimize delays and disputes.

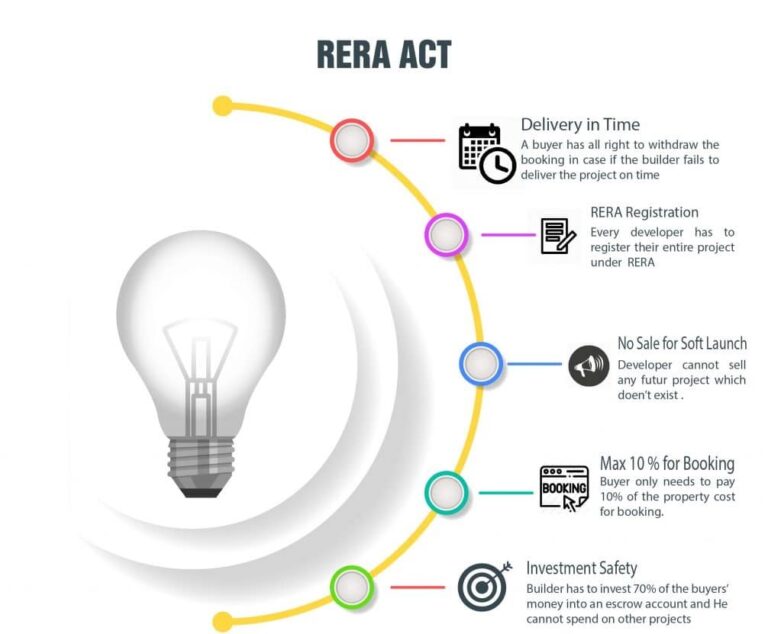

Key Features of RERA

Mandatory Registration of Projects

Under RERA, developers are required to register their real estate projects with the regulatory authority before advertising or selling them. This ensures that all projects adhere to prescribed standards and guidelines, reducing the risk of fraudulent activities.

Transparency and Disclosure

RERA mandates developers to provide accurate and comprehensive information about their projects, including project details, approvals, timelines, and financials. This transparency empowers homebuyers to make informed decisions and reduces the likelihood of disputes.

Escrow Account Mechanism

The escrow account mechanism is a fundamental component of the Real Estate Regulatory Authority (RERA) framework, designed to safeguard the interests of homebuyers and ensure the timely completion of real estate projects. Under this mechanism, developers are required to deposit a specified percentage of project funds into designated escrow accounts maintained with authorized banks.

The funds deposited in the escrow accounts are earmarked exclusively for project-related expenses and can only be utilized for purposes approved by RERA. This includes land acquisition, construction costs, payment to contractors and suppliers, and other project-related expenditures.

The escrow account mechanism serves several important purposes:

Financial Transparency: By segregating project funds in dedicated escrow accounts, the mechanism promotes financial transparency and accountability. Homebuyers can be assured that their investments are being utilized solely for the intended project and are not at risk of being diverted for other purposes.

Protection of Homebuyers’ Funds: Depositing funds into escrow accounts provides a layer of protection for homebuyers’ investments. In the event of developer insolvency or project delays, the funds remain secure and can be used to ensure the completion of the project as per the agreed-upon timelines.

Risk Mitigation: The escrow account mechanism helps mitigate the risk of fund mismanagement or misuse by developers. By requiring developers to adhere to strict guidelines for fund utilization, RERA minimizes the likelihood of financial irregularities and fraud in the real estate sector.

Promotion of Timely Project Completion: By ensuring that developers have sufficient funds available for project-related expenses, the escrow account mechanism helps promote timely project completion. Developers are incentivized to adhere to project timelines and deliver on their commitments to homebuyers, as failure to do so can result in penalties and sanctions.

Penalty for Non-Compliance

Penalty for non-compliance is a crucial aspect of the Real Estate Regulatory Authority (RERA) framework, serving as a deterrent against unethical practices and violations of regulatory provisions. RERA imposes strict penalties on developers who fail to comply with the prescribed guidelines and regulations, ensuring accountability and adherence to the law.

The penalties for non-compliance with RERA regulations can vary depending on the nature and severity of the violation. Some common penalties include fines, sanctions, and even imprisonment for severe infractions. Developers may be penalized for various offenses, such as:

Delayed Project Delivery: Developers who fail to complete their projects within the stipulated timelines may face penalties for project delays. RERA imposes fines and sanctions to discourage delays and ensure timely delivery of projects to homebuyers.

Misleading Advertisements: Developers are required to provide accurate and transparent information about their projects. Any misleading or false advertisements can result in penalties, including fines and corrective actions to rectify the misinformation.

Violation of Buyer Rights: RERA protects the rights of homebuyers and imposes penalties on developers who infringe upon these rights. Developers may face penalties for unfair practices, breaches of contract, or failure to fulfill their obligations to homebuyers.

Non-Registration of Projects: Developers are mandated to register their projects with RERA before advertising or selling them. Failure to register projects can lead to penalties, including fines and legal repercussions.

Non-Compliance with Regulatory Provisions: Developers must comply with various regulatory provisions laid down by RERA, such as maintaining project accounts, submitting regular project updates, and adhering to prescribed standards. Non-compliance with these provisions can result in penalties and sanctions.

Impact of RERA on the Real Estate Sector

The Real Estate Regulatory Authority (RERA) has had a significant impact on the real estate sector, bringing about positive changes and improvements across various aspects of the industry. Here are some key impacts of RERA on the real estate sector:

Boosting Consumer Confidence: One of the most notable impacts of RERA is the boost in consumer confidence. RERA has introduced transparency, accountability, and buyer protection measures, giving homebuyers greater trust in the real estate market.

Streamlining Project Execution: RERA’s regulations have compelled developers to streamline project execution processes. With stricter guidelines and penalties for project delays, developers are now more focused on timely project completion, leading to fewer delays and disputes.

Enhancing Transparency: RERA mandates developers to provide comprehensive information about their projects, including approvals, timelines, and financials. This transparency empowers homebuyers to make informed decisions and reduces the risk of fraudulent practices.

Improving Project Quality: With increased scrutiny and accountability under RERA, developers are incentivized to maintain higher standards of construction quality and project management. This has led to improved project quality and better outcomes for homebuyers.

Reducing Disputes: RERA’s emphasis on transparency and accountability has resulted in fewer disputes between developers and homebuyers. Clear guidelines and mechanisms for dispute resolution have helped mitigate conflicts and ensure fair outcomes for all parties involved.

Attracting Foreign Investment: RERA’s regulatory framework has made the Indian real estate market more attractive to foreign investors. The increased transparency and investor protection measures have boosted confidence among foreign investors, leading to greater capital inflows in the sector.

Promoting Affordable Housing: RERA encourages the development of affordable housing projects by providing incentives and support to developers. This has helped address the housing needs of middle and lower-income segments of society, contributing to social and economic development.

Streamlining Project Execution

Streamlining project execution is a fundamental objective of the Real Estate Regulatory Authority (RERA). By imposing stringent regulations and oversight mechanisms, RERA aims to ensure that real estate projects are completed efficiently and within the stipulated timelines.

One of the key ways in which RERA achieves this objective is by mandating developers to adhere to prescribed guidelines and standards throughout the project lifecycle. Developers are required to register their projects with RERA before advertising or selling them, providing detailed information about project timelines, approvals, and financials.

Additionally, RERA mandates developers to deposit a specified percentage of project funds into designated escrow accounts, which can only be used for project-related expenses. This mechanism helps prevent fund diversion and ensures that sufficient funds are available for timely project completion.

Furthermore, RERA imposes penalties on developers for non-compliance with regulatory provisions, including project delays and violations of buyer rights. These penalties act as deterrents against unethical practices and incentivize developers to prioritize project execution and adhere to timelines.

As a result of these measures, project execution in the real estate sector has become more streamlined and efficient. Developers are compelled to adopt best practices and efficient project management techniques to avoid penalties and maintain compliance with RERA regulations.

Encouraging Foreign Investment

Encouraging foreign investment is another key objective of the Real Estate Regulatory Authority (RERA). By implementing transparent regulations and promoting accountability in the real estate sector, RERA aims to create a conducive environment for foreign investors.

The increased transparency and regulatory oversight provided by RERA instill confidence in foreign investors, as they can rely on standardized processes and legal protections when investing in Indian real estate. This confidence leads to greater capital inflows into the sector, which, in turn, fuels economic growth and development.

Foreign investment plays a crucial role in the real estate market, bringing in expertise, technology, and capital that contribute to the overall improvement of infrastructure and urban development. Additionally, foreign investors often bring international best practices and standards, which help raise the quality of real estate projects in India.

Furthermore, by attracting foreign investment, RERA contributes to job creation, skill development, and the overall competitiveness of the real estate sector. Foreign investors bring new opportunities for collaboration and partnership, fostering innovation and driving efficiency in project execution.

Conclusion

In conclusion, the Real Estate Regulatory Authority (RERA) plays a pivotal role in transforming the real estate sector in India. By promoting transparency, accountability, and consumer protection, RERA has ushered in a new era of trust and confidence in the real estate market. As stakeholders continue to adapt to RERA’s regulatory framework, the sector is poised for sustainable growth and development.

FAQs

- What are some emerging trends in luxury real estate?

- What is unlocking opportunities: Exploring the world of crowdfunded real estate?

- How are the Richest real estate investors?

- What are The Future of Real Estate: 10 Bold Predictions for 2024?