The real estate sector in India is a significant contributor to the country’s economy, playing a pivotal role in driving economic growth, employment generation, and infrastructure development. With rapid urbanization and a burgeoning population, the demand for residential, commercial, and retail spaces has been on the rise, making India one of the most attractive destinations for real estate investments globally.

Introduction

The real estate sector in India encompasses various segments, including residential, commercial, retail, and hospitality. It has been a key driver of economic growth, contributing significantly to the country’s GDP and employment generation. Over the years, the sector has witnessed remarkable growth and transformation, fueled by favorable government policies, urbanization trends, and increasing investments.

Historical Perspective

The evolution of the real estate sector in India can be traced back to ancient times when civilizations flourished along the banks of rivers like the Indus and the Ganges. However, modern real estate development began during the British colonial era, with the establishment of organized cities and townships. Post-independence, the sector witnessed gradual growth, marked by the development of housing colonies, industrial estates, and commercial complexes.

Current Scenario

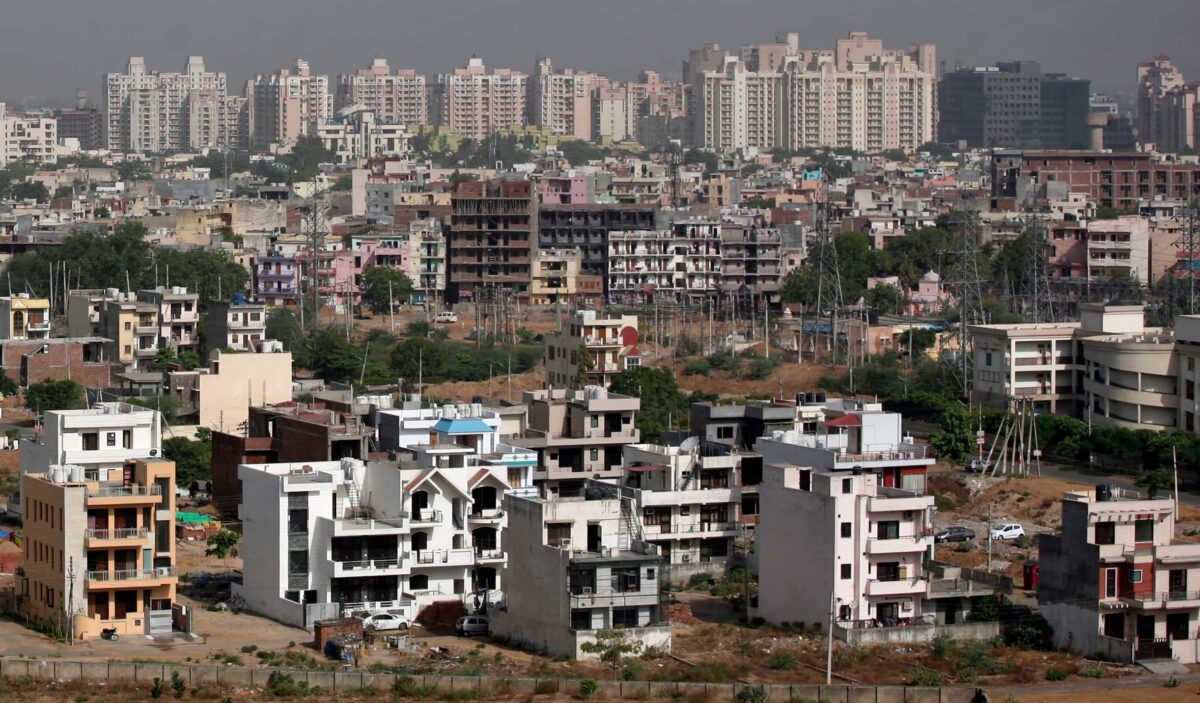

Today, the real estate sector in India is characterized by dynamic growth and diversification, with numerous players operating across different segments. The residential segment remains the largest contributor to the sector, driven by increasing urbanization, rising disposable incomes, and favorable demographics. Additionally, the commercial and retail segments have also witnessed significant expansion, fueled by the growth of the IT/ITeS sector, organized retail, and e-commerce.

Factors Driving Growth

Several factors have contributed to the growth of the real estate sector in India. Population growth and urbanization have led to a surge in demand for housing and infrastructure. Government initiatives such as the Smart Cities Mission, Housing for All, and the Real Estate Regulatory Authority (RERA) have provided a significant impetus to the sector by streamlining processes, enhancing transparency, and protecting consumer interests. Furthermore, the liberalization of FDI norms has attracted substantial foreign investment into the sector, further driving its growth.

Challenges Faced

Despite its growth prospects, the real estate sector in India faces several challenges. Regulatory issues and bureaucratic hurdles often delay project approvals and increase compliance costs. Funding and liquidity challenges, especially in the wake of the COVID-19 pandemic, have led to a slowdown in construction activity and project execution. Additionally, the sector is susceptible to market fluctuations, policy changes, and global economic uncertainties, which pose significant risks to investors and developers.

Market Segments

The Indian real estate market comprises various segments catering to diverse consumer needs. The residential segment, encompassing apartments, villas, and plotted developments, remains the largest segment, driven by strong demand from end-users and investors alike. The commercial segment, comprising office spaces, IT parks, and SEZs, has also witnessed robust growth, fueled by the expansion of the services sector and increasing demand from corporates.

Emerging Trends

Several emerging trends are shaping the future of the real estate sector in India. The rise of co-working spaces and flexible office solutions is transforming the commercial real estate landscape, catering to the evolving needs of the workforce. Sustainable and green buildings are gaining traction, driven by environmental concerns and regulatory mandates. Moreover, the adoption of technology in construction, such as Building Information Modeling (BIM) and Internet of Things (IoT), is enhancing efficiency, reducing costs, and improving project outcomes.

Investment Opportunities

India offers a plethora of investment opportunities in the real estate sector across various asset classes. Residential properties, especially affordable housing projects, continue to attract investors due to their strong demand and favorable government incentives. Commercial real estate, including office spaces and retail malls, offers stable rental yields and capital appreciation potential. Additionally, the introduction of REITs has provided investors with an avenue to invest in income-generating commercial properties, offering liquidity and diversification benefits.

Regional Analysis

The real estate market in India is heterogeneous, with different regions exhibiting varying levels of growth and potential. Metropolitan cities like Mumbai, Delhi-NCR, Bangalore, and Hyderabad continue to be the preferred destinations for real estate investments, owing to their robust infrastructure, business environment, and demand dynamics. Tier II and III cities are also witnessing rapid urbanization and infrastructure development, presenting lucrative opportunities for developers and investors.

Future Outlook

Despite short-term challenges, the long-term outlook for the real estate sector in India remains positive. The government’s focus on infrastructure development, affordable housing, and urban renewal initiatives is expected to drive demand and investment in the sector. Moreover, the emergence of new asset classes such as warehousing, logistics, and data centers is expected to further diversify the real estate landscape and attract institutional capital. However, addressing regulatory bottlenecks, enhancing transparency, and restoring investor confidence will be crucial for sustaining long-term growth and realizing the sector’s full potential.

Conclusion

In conclusion, the real estate sector in India plays a pivotal role in driving economic growth, creating employment opportunities, and enhancing infrastructure development. With favorable demographics, urbanization trends, and government initiatives, the sector offers immense potential for investors, developers, and stakeholders. However, addressing regulatory challenges, ensuring transparency, and adapting to emerging trends will be essential for navigating the evolving market dynamics and capitalizing on the vast opportunities that the Indian real estate sector has to offer.

FAQs

- What are some emerging trends in luxury real estate?

- What is unlocking opportunities: Exploring the world of crowdfunded real estate?

- How are the Richest real estate investors?